Investing in Liquid Alternatives

Identifying investment opportunities across a growing spectrum of strategies

April 28, 2015 | Convene Conference Center, New York City

This conference has been accepted by the CFP Board for 9 CE credits.

IMCA has accepted this conference for 9 hours of CE credit towards the CIMA®, CIMC® and CPWA® certifications

The Details

Fund manager presentations are now available from the event as well as video interviews and photos of members of our speaking faculty. Click on the side bar for more details.

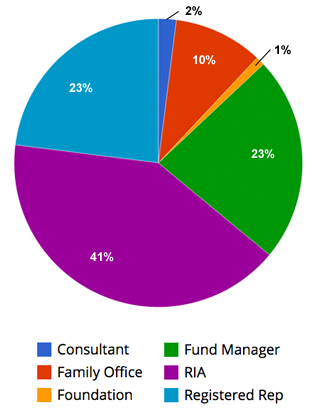

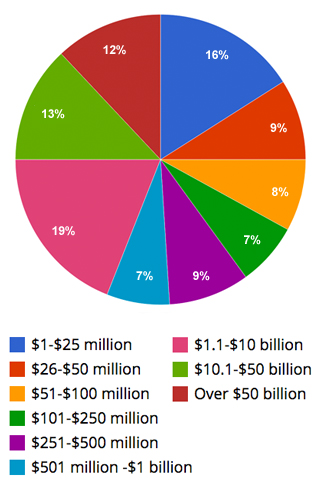

Attendee Profile

51% of Attendees had AUM>$500 Million

Topics Included

- Long/Short Equity Strategies

- Alternative Fixed Income

- Global Macro Strategies

- Arbitrage & Event Strategies

- Managed Futures Strategies

- Volatility as an Investment Strategy

- Private Equity: Investing Across the Liquidity Spectrum

- Allocating to Liquid Alternatives in a Multi-Asset Portfolio

What Makes Our Event Unique

- Developed by investment and fund managers for advisors and institutional investors, with buyside-only attendance

- 100% investment & fund manager (PM, C-level exec, Portfolio Strategist or Analyst) speaking faculty

- Strategy focused, not industry-focused

- Drill down into the approach of the strategy with the fund manager

KEYNOTE SPEAKER

JOEL GREENBLATT

Managing Principal and Co-Chief Investment Officer

Gotham Asset Management

CONFERENCE CHAIRPERSON

Co-Founder & Co-Chairman

Lake Partners

OTHER FEATURED SPEAKERS

DAVID BAKER

Partner, Portfolio Manager

Perella Weinberg Partners

ROY BEHREN

Managing Member & Portfolio Manager

Westchester Capital Management

KEITH BLACK

Managing Director, Curriculum & Exams

CAIA

ANTHONY CAINE

Founder & Chairman

LJM Partners

TOM CLARKE

Co-Portfolio Manager

William Blair Macro Allocation Fund

WALTER DAVIS

Alternatives Investment Strategist

Invesco

JEFF GARY

Senior Portfolio Manager

Avenue Capital Group

TANYA GHALEB-HARTER

Dir. Alternative Investments

Merrill Lynch

ROB GUTTSCHOW

Senior Portfolio Manager

First Trust Advisors

RYAN LEVITT

Principal

Pomona Capital

WILLIAM MARR

Senior Managing Dir., Head of Liquid Alternative Investments

State Street Global Advisors

TAM MCVIE

Investment Director

Standard Life Investments

K.C. NELSON

Managing Director, Portfolio Manager

Driehaus Capital Management

R. TY POWERS

Director, Portfolio Management

Hatteras Funds

THOMAS SCHNEEWEIS

Managing Partner

S Capital Management

MICHAEL SHANNON

Managing Member, Portfolio Manager

Westchester Capital Management

MARK SUNDERHUSE

Founder, Managing Director & Co-Portfolio Manager

Red Rocks Capital

RYAN TAGAL

Vice President – Product Management

Envestnet Asset Management