Investing in MLPs

MLP income & total return strategies in a volatile energy environment

This conference was accepted by the CFP Board for 8 CE credits.

IMCA accepted this conference for 8 hours of CE credit towards the CIMA®, CIMC®, and CPWA® certifications.

The Details

Key takeaways from the event can be found by clicking here.

Speaker presentations are also now available from the event. Click on the side bar for more details.

Given the continued volatility in the energy sector, companies are re-evaluating their business models which has resulted in investors asking many questions. During these times, it’s critical for companies to be accessible to investment professionals in order to provide guidance and reassurance moving forward. And although 2015 was a very tough year in the energy sector, being opportunistic at times of market dislocations like these often deliver the highest returns to investors.

With a new paradigm seemingly in place, we’re looking forward to our next Investing in MLPs conference as the year ahead will be an excellent opportunity for investment professionals looking to access the MLP space to better assess the overall energy landscape by doing their due diligence and feel more confident ahead of making their 2017 investment allotments.

Enter your name and email below and stay up-to-date on further developments.

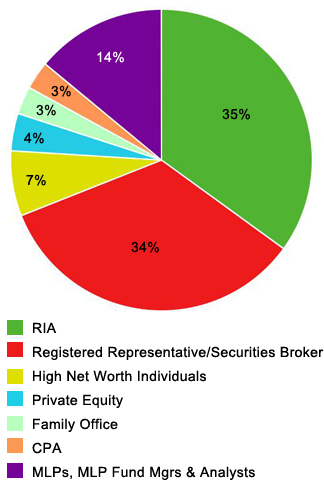

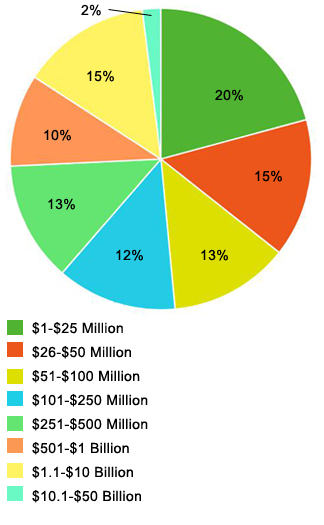

Attendee Profile

40% of Attendees had AUM>$250 Million

Topics Included

- How are Master Limited Partnerships formed and structured

- Overview of trends driving the expansion of the asset class

- Valuation metrics and approaches used in selecting MLPs

- What are the tax considerations associated with MLPs and packaged products

- How are investors using MLPs

- What is the best investment vehicle (closed-end fund, ETF, ETN, mutual fund) for accessing MLPs

- What are the benefits and constraints to Incentive Distribution Rights

- How could export and tax regulation impact MLPs

- Comparing yield strategies: MLPs vs. Yieldcos vs. Energy REITs vs. BDCs

- Looking under the hood: What kind of companies are in MLPs

What Makes Our Event Unique

- Developed by investment and fund managers for advisors and institutional investors, with buyside-only attendance

- 100% investment & fund manager (PM, C-level exec, Portfolio Strategist or Analyst) speaking faculty

- Strategy focused, not industry-focused

- Drill down into the approach of the strategy with the fund manager

CONFERENCE CHAIRPERSON

Co-Founder & Managing Director

MLPData

FEATURED SPEAKERS

RYAN CARNEY

Partner, Tax

Vinson & Elkins

RICHARD S. DASKIN, CFA, CFP(R)

MLP strategy sub advisor to Cumberland Advisors

CIO, RSD Advisors

SCOTT DILLOW

National MLP Tax Partner

PwC

DAPHNE FOSTER

CFO

Global Partners LP

JOHN GRAVES

Fracking

The 7% Solution

2012 Best Personal Finance Book, IFA Gold medal

JAY HATFIELD

Co-Founder & President

Infrastructure Capital Advisors

DAVID HEFLIN

Vice President

Goldman Sachs

JEREMY HELD

Sr. Vice President, Dir. Research

ALPS Portfolio Solutions

BEN HUNT

Chief Risk Officer

Salient/Forward

KRISTINA KAZARIAN

Director, MLPs & Midstream

Deutsche Bank

MARY LYMAN

Executive Director

Master Limited Partnership Association (MLPA) (formerly known as the NAPTP)

LAURA PARELLO

Managing Director

PwC

ROBERT PRADO

Managing Director

PwC

GREG REID

President - Salient MLP Complex

Salient/Forward

RICHARD ROBERT

EVP & CFO

Vanguard Natural Resources, LLC

BRIAN SULLEY

Vice President

Tortoise Capital Investors